Seattle Real Estate Listings: A Retirement Downsizing Guide for Homeowners in Seattle, WA

February 4, 2026

For many Seattle homeowners, retirement is no longer a distant milestone. It is approaching quickly and bringing important housing decisions with it. If you are exploring Seattle real estate listings as part of a retirement or downsizing plan, you are not alone.

Across the United States, nearly 12,000 people turn 65 every day, according to national census data. A growing share of these homeowners plan to retire within the next two years. In Seattle, where home values have risen significantly over the past decade, this transition often creates new opportunities rather than limitations.

This guide explains why many homeowners are choosing to downsize, how Seattle real estate equity makes it possible, and how working with a trusted Seattle real estate agent can help you plan your next chapter with confidence.

Why Downsizing Makes Sense in the Seattle Real Estate Market

Downsizing is not about giving up comfort or lifestyle. For many retirees, it is about making life easier while preserving financial flexibility. Seattle homeowners often discover that a smaller or more functional home better supports their retirement goals.

In the current Seattle real estate market, downsizing may offer several advantages:

- Less time spent on maintenance and repairs

- Lower monthly expenses for utilities and insurance

- Homes designed for accessibility and long-term comfort

- Greater freedom to travel or relocate within Washington

Retirement changes how you use your home. Many homeowners find that space once needed for work, entertaining, or raising children is no longer essential. A well-planned move allows you to keep what matters while simplifying everything else.

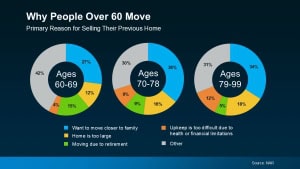

Why Homeowners Over 60 Are Moving

Data from the National Association of Realtors shows that lifestyle changes drive most moves for homeowners over 60. Market timing is rarely the primary reason. Instead, retirees focus on quality of life and long-term planning.

Common Reasons for Downsizing in Seattle

- Moving closer to children, grandchildren, or longtime friends

- Choosing homes with fewer stairs and easier layouts

- Retiring and no longer needing proximity to work

- Reducing ongoing housing costs tied to maintenance

Seattle offers a wide range of housing options that appeal to retirees, including condos, townhomes, and single-level homes. Many buyers search for Seattle WA homes that balance location, walkability, and ease of living.

Downsizing allows homeowners to align their housing with their future needs instead of past routines.

Home Equity Is the Key Advantage for Seattle Homeowners

One of the biggest reasons downsizing is more achievable today is home equity. Seattle homeowners have benefited from long-term appreciation, especially those who have owned their homes for many years.

According to national housing data, the average homeowner has nearly $300,000 in equity. In Seattle, that number is often higher due to strong price growth and limited housing supply.

How Equity Creates More Options

- Higher sale proceeds can fund a new home purchase

- Smaller homes may require less or no mortgage

- Equity can support retirement savings or travel plans

When homeowners remain in one property for decades, two things usually happen. The home value increases, and the mortgage balance decreases. This combination creates flexibility when planning retirement housing.

Many sellers exploring homes for sale in Seattle Washington are surprised by how much buying power their equity provides.

Seattle Housing Options for Retirement Living

Seattle offers diverse housing styles suitable for downsizing. Choosing the right option depends on your lifestyle, health needs, and long-term goals.

1. Condos and Townhomes

Condos appeal to retirees seeking low-maintenance living. Many buildings include elevators, secure parking, and proximity to amenities. Townhomes offer more privacy while still reducing upkeep.

2. Single-Level Homes

Rambler-style homes remain popular with retirees who want private outdoor space without stairs. These properties are in high demand across Seattle neighborhoods.

3. Urban vs. Residential Neighborhoods

Some retirees prefer walkable urban areas like Capitol Hill or Queen Anne. Others choose quieter neighborhoods with easier parking and access to nature. A knowledgeable real estate agent in Seattle Washington can help match location to lifestyle.

Timing Your Move Without Pressure

Downsizing does not require rushing to sell. The most successful transitions begin with planning rather than listing. Understanding your options helps you move on your own timeline.

Working with experienced real estate agents in Seattle Washington allows you to:

- Estimate your home value accurately

- Review current Seattle Washington houses for sale

- Compare buying and selling scenarios

- Coordinate sale and purchase timing

The goal is clarity, not commitment. Many homeowners explore downsizing months or even years before making a move.

Why Working With a Top Seattle Real Estate Agent Matters

Downsizing involves more than a transaction. It requires strategic planning, market knowledge, and local expertise. The best real estate agent in Seattle understands both the emotional and financial sides of retirement moves.

A trusted Seattle real estate brokerage can:

- Provide realistic pricing guidance

- Identify homes suited for long-term living

- Navigate competitive Seattle listings

- Protect your interests throughout the process

If you are searching for a realtor near me who understands retirement planning, local experience matters.

Selling and Buying in Today’s Seattle Market

Seattle remains a competitive market with limited inventory. Downsizers often compete with first-time buyers and investors for smaller homes. Preparation improves outcomes.

Key considerations include:

- Understanding current Seattle real estate listings

- Evaluating condo rules and HOA fees

- Planning for inspection and accessibility needs

Experienced top real estate agents Seattle WA help you navigate these details with confidence.

Start With a Conversation, Not a Sale

If retirement is on the horizon, the first step is not selling your home. It is understanding what your equity and the Seattle market make possible.

A simple, no-pressure conversation with a Seattle real estate agent can clarify your options. Downsizing should support your next chapter, not complicate it.

Frequently Asked Questions About Downsizing in Seattle:

– When should I start planning to downsize?

Many homeowners begin planning one to two years before retirement. Early planning provides flexibility and better decision-making.

– Is now a good time to sell a home in Seattle?

Market conditions vary by neighborhood and home type. A local agent can provide up-to-date insights.

– Can I buy a smaller home without a mortgage?

Many Seattle homeowners use equity to purchase smaller homes outright or reduce monthly payments.

– Are condos a good option for retirees?

Condos can be ideal due to reduced maintenance, but HOA rules and fees should be reviewed carefully.

– How do I find the right real estate agent near me?

Look for agents with local experience, strong reviews, and a clear understanding of retirement transitions.

– What neighborhoods are popular for downsizing in Seattle?

Popular areas include Queen Anne, Ballard, Capitol Hill, and West Seattle, depending on lifestyle preferences.

Final Thoughts on Downsizing in Seattle

Downsizing is about creating a home that supports your future. With strong equity, diverse housing options, and expert guidance, Seattle homeowners have more choices than they realize.

If you are exploring Seattle real estate options for retirement, a thoughtful plan can turn change into opportunity.